Page 191 - SC SCAR 2023 ENGLISH Flipbook

P. 191

PART 5 ORGANISATION INFORMATION

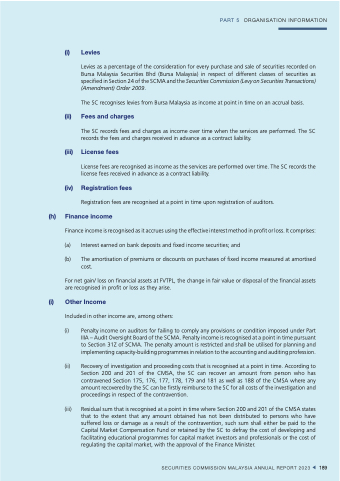

(i) Levies

Levies as a percentage of the consideration for every purchase and sale of securities recorded on Bursa Malaysia Securities Bhd (Bursa Malaysia) in respect of different classes of securities as specified in Section 24 of the SCMA and the Securities Commission (Levy on Securities Transactions) (Amendment) Order 2009.

The SC recognises levies from Bursa Malaysia as income at point in time on an accrual basis.

(ii) Fees and charges

The SC records fees and charges as income over time when the services are performed. The SC records the fees and charges received in advance as a contract liability.

(iii) License fees

License fees are recognised as income as the services are performed over time. The SC records the license fees received in advance as a contract liability.

(iv) Registration fees

Registration fees are recognised at a point in time upon registration of auditors.

(h) Finance income

Finance income is recognised as it accrues using the effective interest method in profit or loss. It comprises:

(a) Interest earned on bank deposits and fixed income securities; and

(b) The amortisation of premiums or discounts on purchases of fixed income measured at amortised cost.

For net gain/ loss on financial assets at FVTPL, the change in fair value or disposal of the financial assets are recognised in profit or loss as they arise.

(i) Other Income

Included in other income are, among others:

(i) Penalty income on auditors for failing to comply any provisions or condition imposed under Part IIIA – Audit Oversight Board of the SCMA. Penalty income is recognised at a point in time pursuant to Section 31Z of SCMA. The penalty amount is restricted and shall be utilised for planning and implementing capacity-building programmes in relation to the accounting and auditing profession.

(ii) Recovery of investigation and proceeding costs that is recognised at a point in time. According to Section 200 and 201 of the CMSA, the SC can recover an amount from person who has contravened Section 175, 176, 177, 178, 179 and 181 as well as 188 of the CMSA where any amount recovered by the SC can be firstly reimburse to the SC for all costs of the investigation and proceedings in respect of the contravention.

(iii) Residual sum that is recognised at a point in time where Section 200 and 201 of the CMSA states that to the extent that any amount obtained has not been distributed to persons who have suffered loss or damage as a result of the contravention, such sum shall either be paid to the Capital Market Compensation Fund or retained by the SC to defray the cost of developing and facilitating educational programmes for capital market investors and professionals or the cost of regulating the capital market, with the approval of the Finance Minister.

SECURITIES COMMISSION MALAYSIA ANNUAL REPORT 2023 189