Overview of the Anti-Money Laundering, Countering Financing of Terrorism and Countering Proliferation of Financing (AML/CFT/CPF) Regime

Securities Commission Malaysia (SC)’s Role in Malaysia’s AML/CFT/CPF Regime

In Malaysia, the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA) is the primary statute which governs the AML/CFT/CPF regime in Malaysia.

The AMLA imposes reporting obligations on reporting institutions to prevent or mitigate money laundering or terrorism financing risks and was enacted in line with the international anti-money laundering standards set by the Financial Action Task Force (FATF).

AML/CFT/CPF is classified as securities laws under the Securities Commission Malaysia Act 1993 (SCMA) empowering the SC to take civil, criminal, and/or administrative actions as deemed necessary to achieve the desired outcomes.

A reporting institution under the AMLA means any person, including branches and subsidiaries of that person who carries out any activity listed in the First Schedule of the AMLA. This includes capital market intermediaries

The AMLA imposes reporting obligations on reporting institutions to prevent or mitigate money laundering or terrorism financing risks and was enacted in line with the international anti-money laundering standards set by the Financial Action Task Force (FATF).

AML/CFT/CPF is classified as securities laws under the Securities Commission Malaysia Act 1993 (SCMA) empowering the SC to take civil, criminal, and/or administrative actions as deemed necessary to achieve the desired outcomes.

A reporting institution under the AMLA means any person, including branches and subsidiaries of that person who carries out any activity listed in the First Schedule of the AMLA. This includes capital market intermediaries

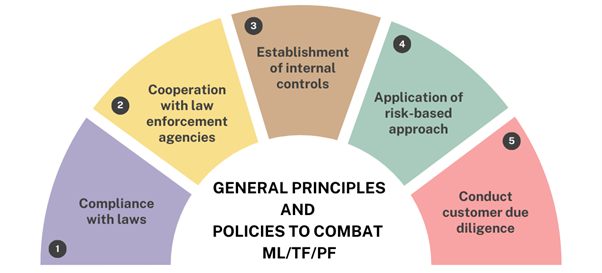

General Principles and Policies to Combat Money Laundering, Terrorism Financing and Proliferation Financing

Anti-Money Laundering, Countering Terrorism Financing & Counter Proliferation Financing

Guidelines on Anti-Money Laundering, Countering Terrorism Financing & Counter Proliferation Financing can be found here:

Note: