Page 196 - SC SCAR 2023 ENGLISH Flipbook

P. 196

PART 5 ORGANISATION INFORMATION

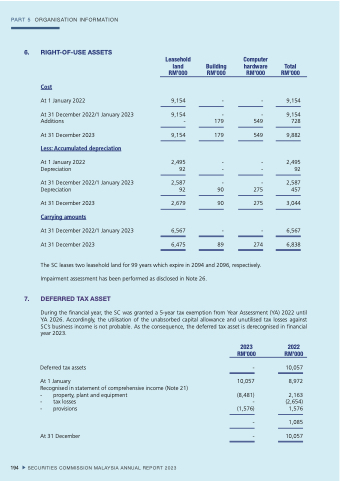

6. RIGHT-OF-USE ASSETS

Cost

At 1 January 2022

At 31 December 2022/1 January 2023 Additions

At 31 December 2023

Less: Accumulated depreciation

At 1 January 2022 Depreciation

At 31 December 2022/1 January 2023 Depreciation

At 31 December 2023

Carrying amounts

At 31 December 2022/1 January 2023

At 31 December 2023

Leasehold

land Building

RM’000 RM’000

9,154 -

9,154 - - 179

9,154 179

2,495 - 92 -

2,587 - 92 90

2,679 90

6,567 -

6,475 89

Computer

hardware Total

RM’000 RM’000

- 9,154

- 9,154 549 728

549 9,882

- 2,495 - 92

- 2,587 275 457

275 3,044

- 6,567

274 6,838

The SC leases two leasehold land for 99 years which expire in 2094 and 2096, respectively. Impairment assessment has been performed as disclosed in Note 26.

7. DEFERRED TAX ASSET

During the financial year, the SC was granted a 5-year tax exemption from Year Assessment (YA) 2022 until YA 2026. Accordingly, the utilisation of the unabsorbed capital allowance and unutilised tax losses against SC’s business income is not probable. As the consequence, the deferred tax asset is derecognised in financial year 2023.

Deferred tax assets

At 1 January

Recognised in statement of comprehensive income (Note 21)

- property, plant and equipment

- tax losses - provisions

At 31 December

2023 RM’000

- 10,057

(8,481) - (1,576)

- -

2022 RM’000

10,057

8,972

2,163 (2,654) 1,576

1,085 10,057

194 SECURITIES COMMISSION MALAYSIA ANNUAL REPORT 2023