Page 197 - SC SCAR 2023 ENGLISH Flipbook

P. 197

PART 5 ORGANISATION INFORMATION

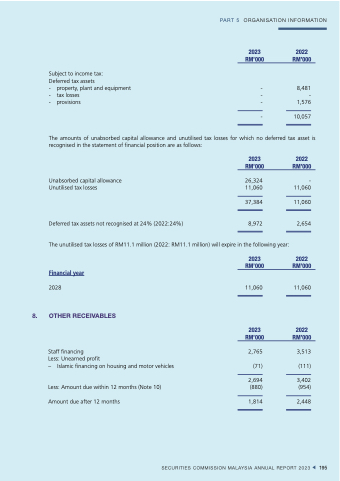

Subject to income tax: Deferred tax assets

- property, plant and equipment

- tax losses - provisions

2023 RM’000

- - -

-

2022 RM’000

8,481 - 1,576

10,057

The amounts of unabsorbed capital allowance and unutilised tax losses for which no deferred tax asset is recognised in the statement of financial position are as follows:

Unabsorbed capital allowance Unutilised tax losses

2023 RM’000

26,324 11,060

37,384

2022 RM’000

- 11,060

11,060

2,654

2022 RM’000

11,060

2022 RM’000

3,513

(111)

3,402 (954)

2,448

Deferred tax assets not recognised at 24% (2022:24%)

The unutilised tax losses of RM11.1 million (2022: RM11.1 million) will expire in the following year:

Financial year

2028

8. OTHER RECEIVABLES

Staff financing

Less: Unearned profit

– Islamic financing on housing and motor vehicles

Less: Amount due within 12 months (Note 10) Amount due after 12 months

8,972

2023 RM’000

11,060

2023 RM’000

2,765

(71)

2,694 (880)

1,814

SECURITIES COMMISSION MALAYSIA ANNUAL REPORT 2023 195