Page 199 - SC SCAR 2023 ENGLISH Flipbook

P. 199

PART 5 ORGANISATION INFORMATION

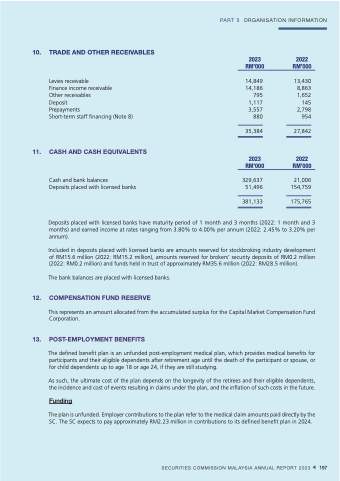

10. TRADE AND OTHER RECEIVABLES

Levies receivable

Finance income receivable

Other receivables

Deposit

Prepayments

Short-term staff financing (Note 8)

11. CASH AND CASH EQUIVALENTS

Cash and bank balances

Deposits placed with licensed banks

2023 RM’000

14,849 14,186 795 1,117 3,557 880

35,384

2023 RM’000

329,637 51,496

381,133

2022 RM’000

13,430 8,863 1,652

145 2,798 954

27,842

2022 RM’000

21,006 154,759

175,765

Deposits placed with licensed banks have maturity period of 1 month and 3 months (2022: 1 month and 3 months) and earned income at rates ranging from 3.80% to 4.00% per annum (2022: 2.45% to 3.20% per annum).

Included in deposits placed with licensed banks are amounts reserved for stockbroking industry development of RM15.6 million (2022: RM15.2 million), amounts reserved for brokers’ security deposits of RM0.2 million (2022: RM0.2 million) and funds held in trust of approximately RM35.6 million (2022: RM28.5 million).

The bank balances are placed with licensed banks.

12. COMPENSATION FUND RESERVE

This represents an amount allocated from the accumulated surplus for the Capital Market Compensation Fund Corporation.

13. POST-EMPLOYMENT BENEFITS

The defined benefit plan is an unfunded post-employment medical plan, which provides medical benefits for participants and their eligible dependents after retirement age until the death of the participant or spouse, or for child dependents up to age 18 or age 24, if they are still studying.

As such, the ultimate cost of the plan depends on the longevity of the retirees and their eligible dependents, the incidence and cost of events resulting in claims under the plan, and the inflation of such costs in the future.

Funding

The plan is unfunded. Employer contributions to the plan refer to the medical claim amounts paid directly by the SC. The SC expects to pay approximately RM2.23 million in contributions to its defined benefit plan in 2024.

SECURITIES COMMISSION MALAYSIA ANNUAL REPORT 2023 197